This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

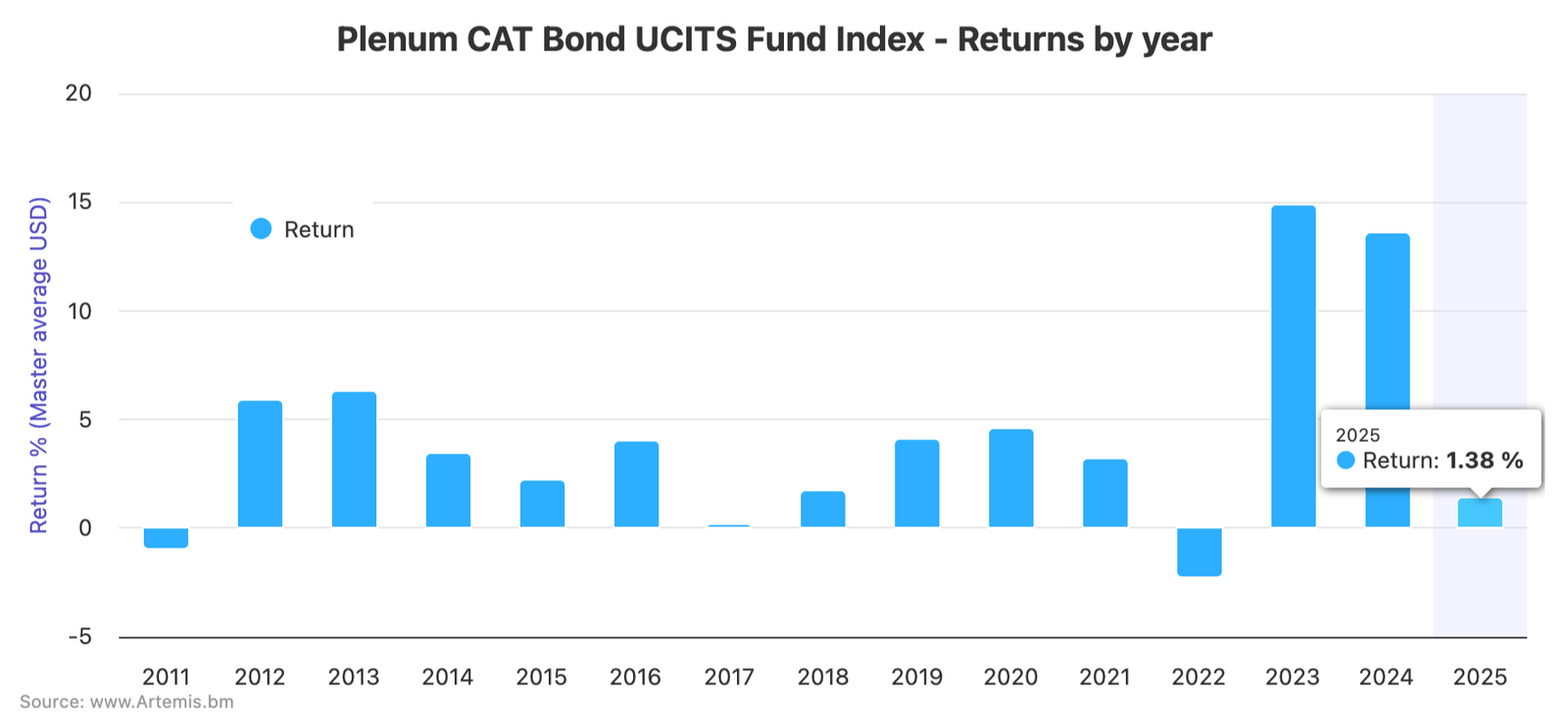

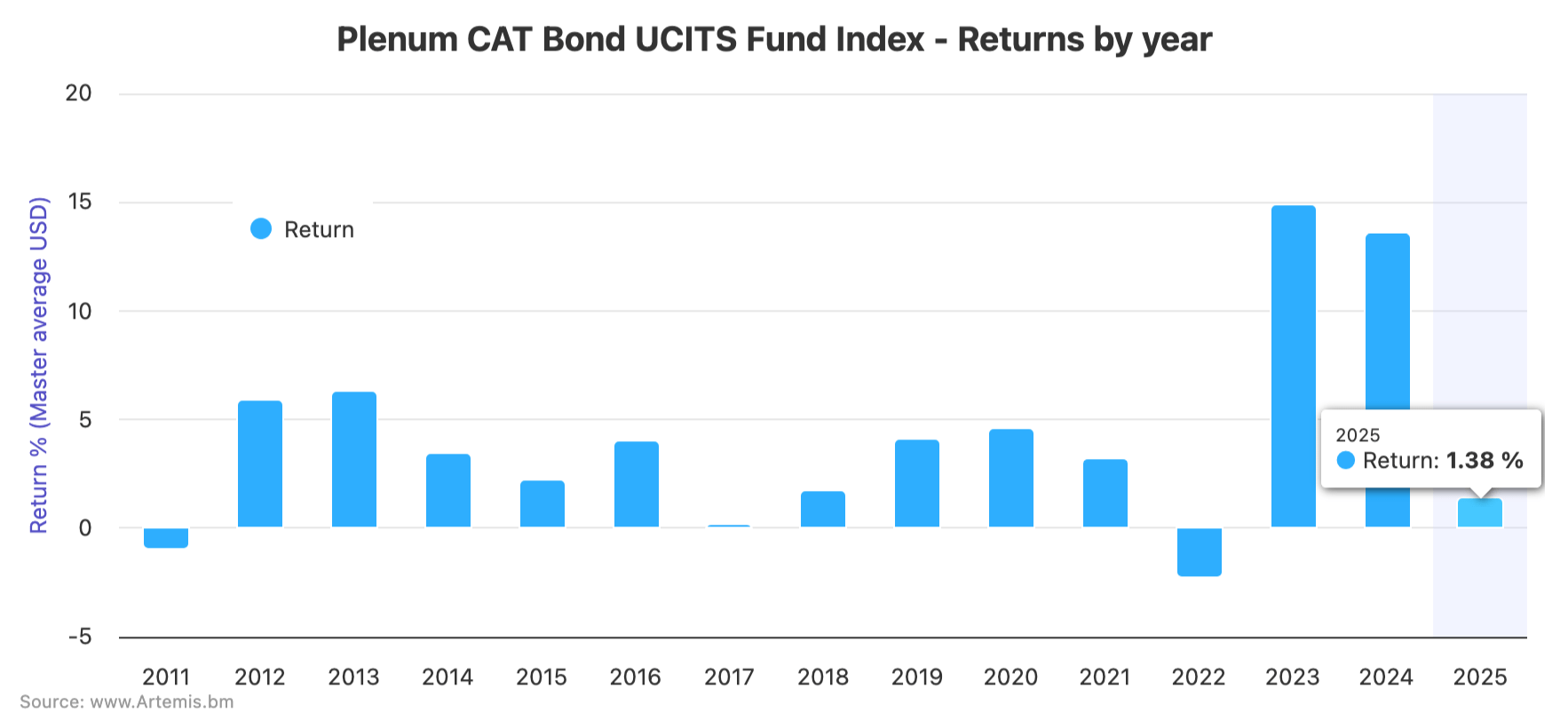

The average return of UCITS catastrophe bond fund strategies was 1.38% for the first-quarter of 2025, according to the Plenum CAT Bond UCITS Fund Indices. But lower-risk cat bond funds led the way by averaging 1.50% for the period as a group, as they generally had less exposure to the California wildfire cat bond mark-downs.

March saw UCITS catastrophe bond fund returns reaching their highest monthly level so far this year, as the mark-to-market effects of the Los Angeles wildfires had lessened throughout last month.

2025 began with UCITS cat bond funds averaging a roughly 0.40% return for the month of January as the initial effects of the wildfire affected certain cat bond’s pricing, after which performance dropped to an average 0.32% return for the month of February, as certain positions wildfire related mark-downs accelerated during that month.

For March 2025, the average return across the UCITS cat bond funds tracked by Plenum Investments Index was 0.56%, taking the average return for the first-quarter of the year to 1.38%.

The wildfires continued to move some cat bond positions during March, which depressed the overall returns still.

But, while the effects of the wildfires haven’t been experienced equally, given differences in cat bond fund manager strategy, it still appears that the average performance across lower-risk strategies had continued to fare better.

In March 2025, the lower-risk cohort of UCITS cat bond funds delivered a 0.54% return, while the higher-risk delivered 0.58%.

But, across the full first-quarter, the lower-risk cat bond funds averaged 1.50%, while the higher-risk only returned 1.24%, resulting in the average performance of 1.38% for the period.

The average return across all the UCITS cat bond funds for the trailing twelve-month period to the end of March 2025 was running at 11.12%.

For the lower-risk cat bond funds the twelve-month trailing return stood at 10.94%, while for the higher-risk strategies it stood higher at 11.22%.

Now, with some of the wildfire exposed aggregate catastrophe bonds looking as if they may get through their annual risk periods without seeing actual losses of principal, there is a chance we see some stronger performances as a result.

However, we’ve yet to see whether there is any effect on cat bond prices from the broader financial market volatility we are seeing at this time, while at the same time strong demand for cat bond investments and seasonality have been acting as competing forces on catastrophe bond market yields, all of which makes performance levels hard to predict, but absent major catastrophe events the UCITS cat bond fund segment should continue to deliver positive returns.

This week, we also reported on UCITS cat bond fund AUM, which has grown 11% in Q1 2025 to reach a new high of $15.3 billion by the end of March.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using this chart.

UCITS cat bond funds average 1.38% return for Q1 2025. Low-risk strategies led the way was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

The average return of UCITS catastrophe bond fund strategies was 1.38% for the first-quarter of 2025, according to the Plenum CAT Bond UCITS Fund Indices. But lower-risk cat bond funds led the way by averaging 1.50% for the period as a group, as they generally had less exposure to the California wildfire cat bond mark-downs.

March saw UCITS catastrophe bond fund returns reaching their highest monthly level so far this year, as the mark-to-market effects of the Los Angeles wildfires had lessened throughout last month.

2025 began with UCITS cat bond funds averaging a roughly 0.40% return for the month of January as the initial effects of the wildfire affected certain cat bond’s pricing, after which performance dropped to an average 0.32% return for the month of February, as certain positions wildfire related mark-downs accelerated during that month.

For March 2025, the average return across the UCITS cat bond funds tracked by Plenum Investments Index was 0.56%, taking the average return for the first-quarter of the year to 1.38%.

The wildfires continued to move some cat bond positions during March, which depressed the overall returns still.

But, while the effects of the wildfires haven’t been experienced equally, given differences in cat bond fund manager strategy, it still appears that the average performance across lower-risk strategies had continued to fare better.

In March 2025, the lower-risk cohort of UCITS cat bond funds delivered a 0.54% return, while the higher-risk delivered 0.58%.

But, across the full first-quarter, the lower-risk cat bond funds averaged 1.50%, while the higher-risk only returned 1.24%, resulting in the average performance of 1.38% for the period.

The average return across all the UCITS cat bond funds for the trailing twelve-month period to the end of March 2025 was running at 11.12%.

For the lower-risk cat bond funds the twelve-month trailing return stood at 10.94%, while for the higher-risk strategies it stood higher at 11.22%.

Now, with some of the wildfire exposed aggregate catastrophe bonds looking as if they may get through their annual risk periods without seeing actual losses of principal, there is a chance we see some stronger performances as a result.

However, we’ve yet to see whether there is any effect on cat bond prices from the broader financial market volatility we are seeing at this time, while at the same time strong demand for cat bond investments and seasonality have been acting as competing forces on catastrophe bond market yields, all of which makes performance levels hard to predict, but absent major catastrophe events the UCITS cat bond fund segment should continue to deliver positive returns.

This week, we also reported on UCITS cat bond fund AUM, which has grown 11% in Q1 2025 to reach a new high of $15.3 billion by the end of March.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using this chart.

UCITS cat bond funds average 1.38% return for Q1 2025. Low-risk strategies led the way was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.