This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

LGT Capital Partners believes that 2025 should see continued growth of the insurance-linked securities (ILS) asset class, as well as attractive allocation opportunities, against a backdrop of rising demand for protection across the insurance and reinsurance industry.

This rising demand for protection is being met by an increased supply of capacity, but LGT Capital Partners explained that supply and demand can find a higher balance in 2025.

This rising demand for protection is being met by an increased supply of capacity, but LGT Capital Partners explained that supply and demand can find a higher balance in 2025.

LGT Capital Partners is a privately-owned global multi-alternatives investment firm and has a dedicated ILS management unit, LGT ILS Partners.

In the investment firm’s Investment Outlook 2025, LGT Capital Partners explains that, within the alternative investment landscape, “the insurance-linked strategies (ILS) market remains attractive, supported by strong demand for insurance coverage.”

The demand for reinsurance capacity and protection has been increasing, driven by loss-heavy previous years, construction and exposure related trends, continued inflationary pressures, rising insured values and increased regulatory requirements.

These factors have helped to drive growth in catastrophe bonds and private ILS instruments and the investment firm believes that, “With disciplined portfolio management, the asset class can offer promising allocation opportunities for 2025.”

The recent 2024 Atlantic hurricane season demonstrated the importance of portfolio discipline, LGT Capital Partners said.

“Ultimately, event activity – with several hurricanes making landfall on the US mainland – underlines the importance of prudent portfolio management in ILS investing, with a clear focus on limiting downside risk,” the investment firm explained.

Discussing the way supply demand factors are manifesting in the ILS market, LGT Capital Partners continued, “While the combination of increased regulatory capital requirements and above-average event activity should now lead to a continued strong price environment, this high demand for protection purchases is also meeting an increased supply of capacity.

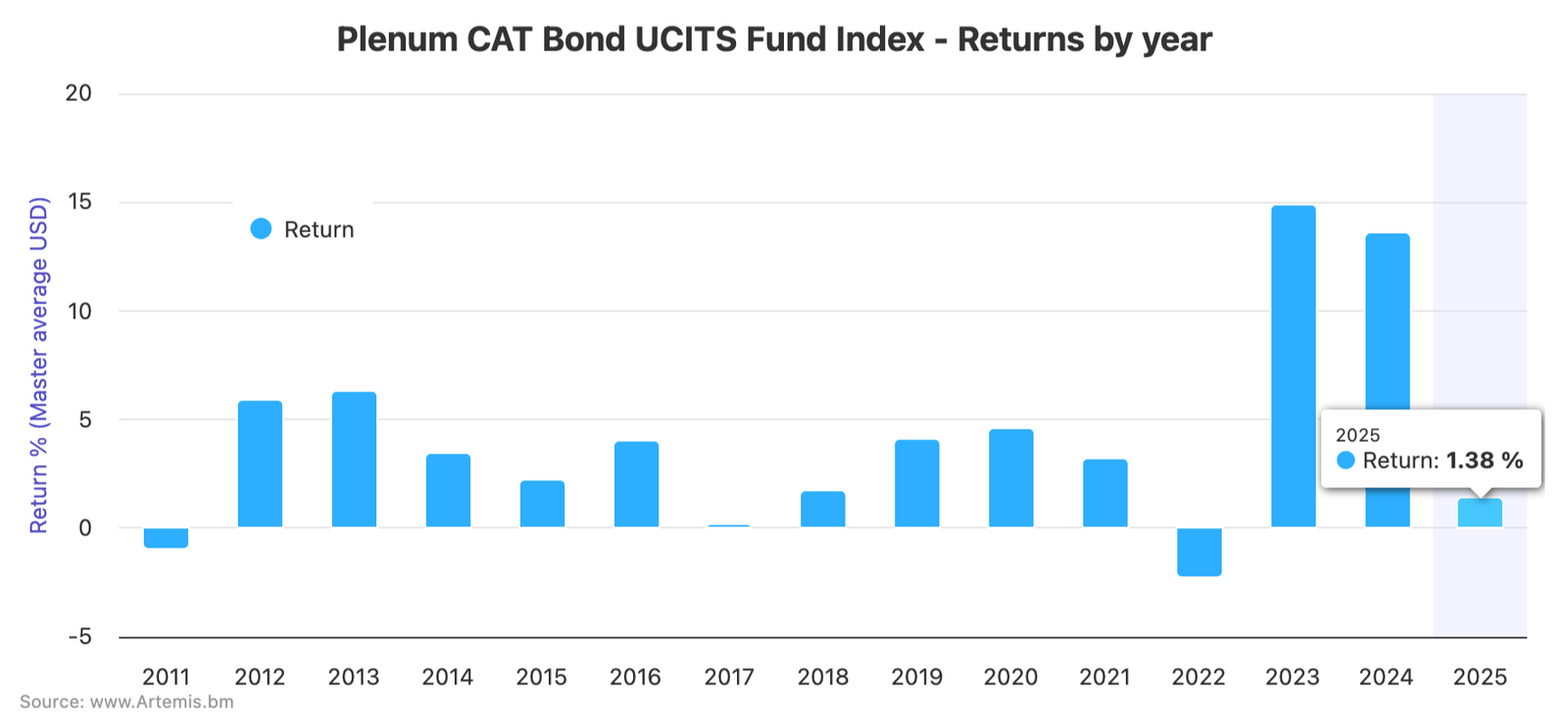

“This growth in available capital is partially driven by the positive returns of ILS managers and reinsurers, who are reallocating their retained earnings. Another important source of fresh capital is the wealth management segment, where we are seeing a continued interest in liquid ILS (cat bond) allocations.”

Martin Fischer, Executive Director working in investor relations at LGT ILS Partners, further commented on what these dynamics mean for 2025 in ILS, “Recent market inflows into the liquid market segment, namely cat bonds, supported a slight softening of premiums.

“The private ILS segment however, which accounts for more than half of the alternative reinsurance market, is expected to see such softening to a lesser extent.

“Our blended strategies are well-prepared to benefit from this divergence, by having access to both market segments.”

Overall, LGT Capital Partners forecasts further growth for the ILS market in 2025, while attractive allocation opportunities will continue to be found in the market.

ILS market growth, attractive allocation opportunities expected in 2025: LGT Capital Partners was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

LGT Capital Partners believes that 2025 should see continued growth of the insurance-linked securities (ILS) asset class, as well as attractive allocation opportunities, against a backdrop of rising demand for protection across the insurance and reinsurance industry.

This rising demand for protection is being met by an increased supply of capacity, but LGT Capital Partners explained that supply and demand can find a higher balance in 2025.

This rising demand for protection is being met by an increased supply of capacity, but LGT Capital Partners explained that supply and demand can find a higher balance in 2025.

LGT Capital Partners is a privately-owned global multi-alternatives investment firm and has a dedicated ILS management unit, LGT ILS Partners.

In the investment firm’s Investment Outlook 2025, LGT Capital Partners explains that, within the alternative investment landscape, “the insurance-linked strategies (ILS) market remains attractive, supported by strong demand for insurance coverage.”

The demand for reinsurance capacity and protection has been increasing, driven by loss-heavy previous years, construction and exposure related trends, continued inflationary pressures, rising insured values and increased regulatory requirements.

These factors have helped to drive growth in catastrophe bonds and private ILS instruments and the investment firm believes that, “With disciplined portfolio management, the asset class can offer promising allocation opportunities for 2025.”

The recent 2024 Atlantic hurricane season demonstrated the importance of portfolio discipline, LGT Capital Partners said.

“Ultimately, event activity – with several hurricanes making landfall on the US mainland – underlines the importance of prudent portfolio management in ILS investing, with a clear focus on limiting downside risk,” the investment firm explained.

Discussing the way supply demand factors are manifesting in the ILS market, LGT Capital Partners continued, “While the combination of increased regulatory capital requirements and above-average event activity should now lead to a continued strong price environment, this high demand for protection purchases is also meeting an increased supply of capacity.

“This growth in available capital is partially driven by the positive returns of ILS managers and reinsurers, who are reallocating their retained earnings. Another important source of fresh capital is the wealth management segment, where we are seeing a continued interest in liquid ILS (cat bond) allocations.”

Martin Fischer, Executive Director working in investor relations at LGT ILS Partners, further commented on what these dynamics mean for 2025 in ILS, “Recent market inflows into the liquid market segment, namely cat bonds, supported a slight softening of premiums.

“The private ILS segment however, which accounts for more than half of the alternative reinsurance market, is expected to see such softening to a lesser extent.

“Our blended strategies are well-prepared to benefit from this divergence, by having access to both market segments.”

Overall, LGT Capital Partners forecasts further growth for the ILS market in 2025, while attractive allocation opportunities will continue to be found in the market.

ILS market growth, attractive allocation opportunities expected in 2025: LGT Capital Partners was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.